- HospicePass Newsletter

- Posts

- Health Plans for Your Staff

Health Plans for Your Staff

Open Enrollment is Here — Find Health Plans for $0 Monthly Premiums*

The 2025 Open Enrollment Period is from November 1, 2024 to January 15, 2025. It's your one time a year to add, switch, or drop your health insurance plan. Finding the right plan can be time consuming and stressful. Healthcare.com makes it easy by connecting you to top insurers like United Healthcare, Aetna, Blue Cross Blue Shield, and many more. In 2025, you may qualify for $0 premiums or annual premium savings exceeding $800*. Find plans that fit you and your budget with Healthcare.com.

In today's competitive job market, healthcare benefits have become more than just a perk—they're a critical component of attracting and retaining top talent. Sponsored by Healthcare.com, this article explores the intricate landscape of employee healthcare plans, helping employers make informed decisions about their benefits strategy.

The Pros of Providing Comprehensive Healthcare Benefits

1. Talent Attraction and Retention

Healthcare benefits are a powerful tool for recruiting top-tier professionals. In a recent survey, 60% of employees cited health insurance as a deciding factor in job selection. By offering robust healthcare coverage, companies can:

Stand out in a competitive job market

Demonstrate commitment to employee well-being

Reduce turnover rates and associated recruitment costs

2. Improved Employee Productivity

Healthy employees are productive employees. Comprehensive healthcare plans contribute to:

Fewer sick days

Earlier detection and treatment of health issues

Reduced stress and improved mental health

Enhanced overall workplace morale

3. Tax Advantages

Employers can benefit from significant tax incentives when providing healthcare benefits:

Tax-deductible healthcare premiums

Potential small business tax credits

Reduced payroll tax liability

Opportunities for pre-tax health savings accounts

The Challenges of Healthcare Benefit Provision

1. Rising Healthcare Costs

The most significant hurdle for many employers is the escalating cost of healthcare:

Annual premium increases outpace inflation

Small to medium-sized businesses face disproportionate financial strain

Balancing comprehensive coverage with budget constraints

2. Administrative Complexity

Managing healthcare benefits involves navigating complex regulatory landscapes:

Compliance with federal and state healthcare regulations

Extensive paperwork and documentation

Keeping up with changing healthcare laws

Selecting and managing appropriate insurance providers

3. One-Size-Doesn't-Fit-All Dilemma

Employees have diverse healthcare needs, making standardized plans challenging:

Different age groups require varied coverage

Individual health conditions necessitate customized approaches

Balancing comprehensive coverage with cost-effectiveness

Strategic Recommendations

Flexible Benefit Structures

Offer tiered healthcare plans

Provide health savings account (HSA) options

Consider supplemental voluntary benefits

Cost Management Strategies

Explore group purchasing options

Implement wellness programs

Negotiate rates with insurance providers

Consider self-funded or partially self-funded plans

Technology and Support

Utilize digital benefits management platforms

Provide employee education on healthcare options

Offer personalized benefits counseling

An Investment in Your Greatest Asset

While providing healthcare benefits presents challenges, it remains a crucial investment in your most valuable resource—your employees. By carefully weighing pros and cons and adopting a strategic approach, employers can create healthcare benefit programs that support both organizational goals and employee well-being.

Sponsored by Healthcare.com - Your Partner in Employee Health Solutions

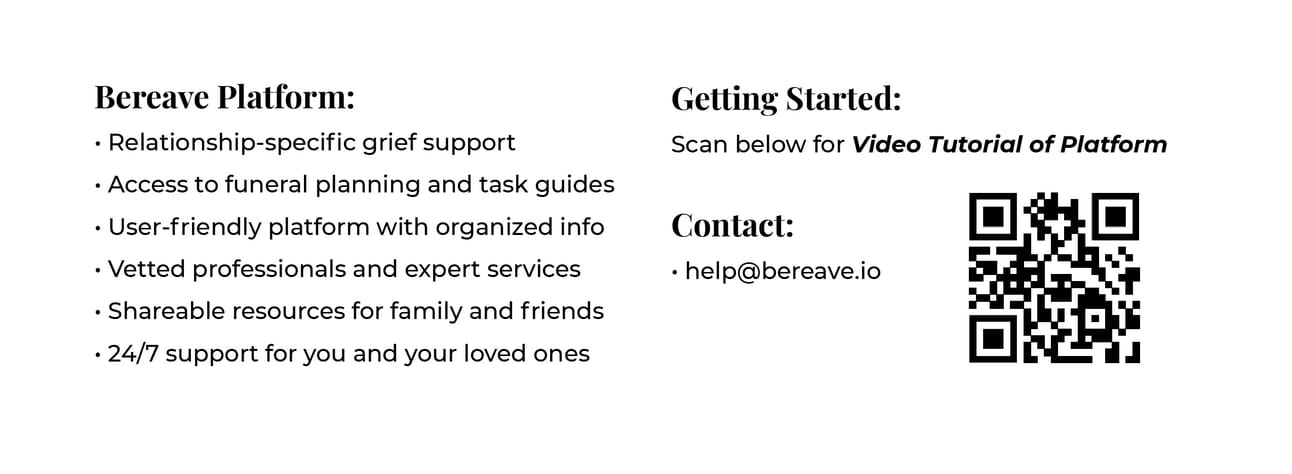

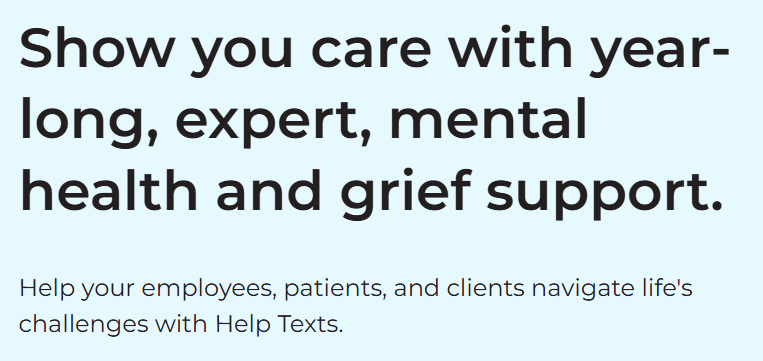

While your team is reviewing ways to make your company the hospice of choice, other companies can be added to your benefits list that will separate you from the others in this tight job market.

Do you have a current mailing list?

Do you currently email your referral base?

What percentage of your referral base is being touched by your agency weekly?

A newsletter will enhance your marketing efforts. The more your referral base sees you, the more information you provide them about the exceptional services you provide, and the more your census grows.

The goal is to provide exceptional and compassionate care for those who choose hospice care for their end-of-life journey.

But this is a business. Maintaining and growing your census is critical to the success of your agency, and your team and provides you the ability to meet and provide exceptional care.

beehiiv is no joke. They make starting a newsletter incredibly easy and the cost is minimal. The ROI on starting a beehiiv newsletter will be the best investment you make in 2025.

The creamers you buy for one coffee bar are more expensive.

Hit the banner below and check it out. The crew at beehiiv will not disappoint.

Reply